Liquid staking primer

Why liquid staking your HYPE with Kinetiq unlocks maximum yield and flexibility

The importance of staking

Staking is the core of Delegated Proof of Stake (DPoS) ecosystems like Hyperliquid.

-

Security

Staking enhances the security of the network by requiring participants (validators) to lock up a certain amount of tokens. This stake serves as a financial incentive for validators to act honestly, as malicious behavior could lead to the loss of their staked funds.

-

Decentralization

By allowing more participants to validate transactions, staking promotes decentralization. Unlike Proof of Work (PoW) systems that rely on expensive, energy-intensive hardware, PoS enables individuals with varying amounts of tokens to participate, widening access and reducing central control.

-

Aligned incentives

Staking aligns the interests of validators with the success of the network. As stakeholders, they are incentivized to maintain the network’s health, stability, and relevance, as their rewards and potentially the value of their holdings depend on the network’s success.

What is liquid staking?

The traditional staking problem

Standard staking requires:

- Locking tokens for long durations

- Manually selecting and monitoring validators

- Giving up liquidity and DeFi access

- Navigating complex delegation mechanics

The result? Many users skip staking and miss out on yield and contributing to network security.

Liquid staking solution

Liquid staking protocols like Kinetiq solve these issues by:

- Giving you immediate liquidity via tradeable tokens (kHYPE)

- Automating validator selection and rebalancing

- Enabling full DeFi utility while earning rewards

- Simplifying the staking experience end-to-end

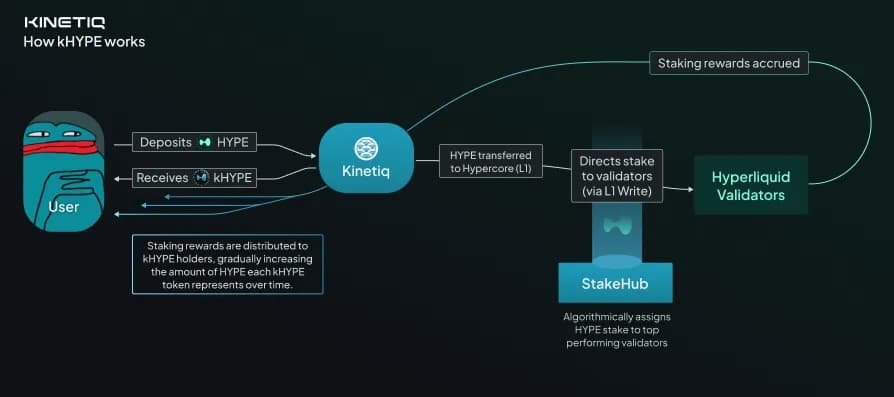

How liquid staking works

The liquid staking process

With Kinetiq, you can stake HYPE and receive kHYPE — a token that represents your staked position while staying liquid and usable across Hyperliquid DeFi.

Summary of steps

-

Stake HYPE

- Stake HYPE tokens to the Kinetiq protocol

- Protocol auto-delegates to top validators via StakeHub

-

Receive kHYPE

- Liquid token represents your staked HYPE

- Appreciates automatically from rewards

-

Use kHYPE anywhere

- Trade on DEXs

- Provide collateral

- Earn additional DeFi yield

-

Withdraw when ready

- Redeem HYPE for kHYPE (after unstaking delay)

- or swap kHYPE for HYPE at any time

- Receive all accumulated rewards

- Redeem HYPE for kHYPE (after unstaking delay)

Kinetiq (liquid staking) vs. alternatives

Direct staking vs. Kinetiq (liquid staking)

| Feature | Direct staking | Liquid staking with Kinetiq |

|---|---|---|

| Liquidity | ❌ Locked | ✅ Fully liquid with kHYPE |

| Validator management | ❌ Manual | ✅ Automated via StakeHub |

| DeFi utility | ❌ None | ✅ Collateral, LP, trading |

| Complexity | ❌ Requires research | ✅ One-click experience |

| Rewards | ✅ Native | ✅ Native + DeFi |

Centralized staking vs. Kinetiq (liquid staking)

| Feature | Centralized services | Kinetiq (liquid staking) |

|---|---|---|

| Custody | ❌ Platform controls funds | ✅ User-controlled |

| Transparency | ❌ Limited | ✅ Fully on-chain |

| Withdrawal policy | ❌ Platform-controlled | ✅ Protocol-defined |

| DeFi integration | ❌ Rare or restricted | ✅ Full composability |

| Risk | ❌ Regulatory & custodial | ✅ Smart contract managed |

Who benefits most from liquid staking?

New users

- Onboard easily without complex delegation

- Maintain full access to your capital

DeFi users

- Use kHYPE in lending, LPs, margin positions

- Dual yield potential

Institutions

- Scalable liquid staking positions

- Transparent validator performance

- Self-custody friendly

Active traders

- Trade or hedge staking exposure

- Arbitrage between kHYPE and HYPE

Considerations & risks

Smart contract risk

- Code risk is minimized through audits, but never zero

Validator risk

- Validators can underperform or be slashed

- StakeHub’s algorithm reduces this via diversification

Liquidity risk

- Market depth can vary for kHYPE

- Price deviations may occur during volatility

Protocol risk

- Governance changes may affect functionality

- Regulatory landscape still evolving

Best practices

- Start small to learn the flow

- Monitor rewards and token price

- Read our audits, check validator stats on StakeHub

This section is a primer on liquid staking in general and its implementation via Kinetiq. For full protocol documentation, please continue through the docs.

On this page